3 April, 2025

New plans submitted for Custom House redevelopment

Learn more

29 November, 2022 · 2 min read

As our City of Tomorrow campaign concludes, we are taking a look at London as a megacity in the future. Using research available, we have asked experts from across our business to reflect on London as the population hits 10 million, the demographic shift that accompanies this, and the practical steps which need to be taken now to deliver sustainable growth. Over the coming days, we will be exploring topics including:

In our first article, Associate Morgan Reece introduces the research behind London’s population growth and how the role of planning and development is responding to this changing demographic profile.

London is now home to more people than at any other point in its history. From a pre-war peak of 8.6m, the city experienced a prolonged period of decline during the second half of the 20th century – falling as low as 6.4m in 1991.

More recently, despite significant numbers of Londoners relocating either temporarily or permanently during the pandemic, the recently-released 2021 Census confirms that the capital’s population still totalled 8.8m on Census day – 200,000 higher than was recorded in 1939. With the majority of those who left temporarily having now returned, it is highly likely that London’s population is now in excess of 9m.

London owes its success on the world stage to its people, who in turn have created its unique culture and driven its economy forward to become (and remain) a key global centre for financial and professional services, as well as an increasingly important hub for tech, higher education and life sciences.

A continuation of this rapid population growth will help to maintain London’s economic status. Still, it is vitally important that growth is delivered in an environmentally and socially sustainable way. To achieve this, it is important to understand both the speed of potential growth and its composition in terms of demographics.

According to GLA population projections, London could reach 10 million as soon as 2033 – based on the highest growth variant scenario. Perhaps more realistically, GLA’s ‘central’ scenarios predict that the threshold will be reached sometime between 2038 and 2042, based on a forward projection of past trends.

This rate of growth is dependent on a number of factors. In particular, London’s chronic housing shortage could act as a significant brake on realising the city’s true potential, which could have a knock-on effect on economic growth.

A slower rate of growth would also have significant economic consequences. We estimate growth based on the ‘Housing – Past delivery’ scenario could result in lost productivity of up to £19.2bn per annum by 2037 compared with the ‘Housing Targets Met’ scenario [1].

This is an economical price which can be ill-afforded from where we now stand, in late 2022, at the onset of what could be a major recession.

All growth scenarios reviewed also indicate significant demographic change, which will have major implications for the types of development delivered in the capital over the coming decades. To explore this in more detail, we have segmented the population into seven age-based categories, each of which reflects a typical stage in life.

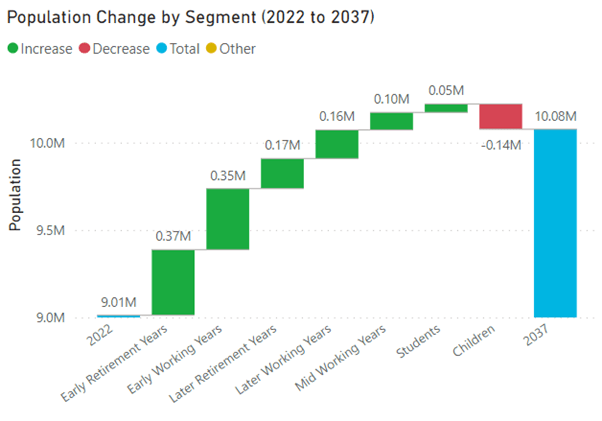

As the chart below shows, the age cohort expected to grow the most by 2037 (under the ‘housing targets met’ scenario) is ‘Early Retirement Years’ (aged 65-79), whilst the ‘Later Retirement Years’ (80+) population is also expected to grow by 170k. Nevertheless, London is expected to remain highly attractive to young people starting out in their careers, and the ‘Early Working Years’ cohort is expected to grow by 350k (plus a further 50k ‘Student’ aged young people). Nevertheless, the projections show slow growth in the Mid and Later working years population and a decline in the number of children – highlighting how the historical trend of families moving out of the city could continue into the future if suitable housing and infrastructure are not made available.

With housing provision at the heart of these numbers, planning and development have an important role to play in shaping how London responds to this changing demographic profile – creating places which meet the needs of an ageing population whilst at the same time maintaining the city’s attractiveness to young people and encouraging more families to remain.

Keep an eye out for more content on the series.

[1] The working age population under the ‘Past Delivery’ scenario would be 422,000 lower than under the ‘Housing Targets Met’ scenario. This equates to the labour force available to London businesses as being 308,000 smaller, considering economic inactivity, unemployment and out-commuters. With GVA per filled job in 2022 estimated by ONS at £83,220 in 2022 prices, this equates to lost productivity reaching £25.6bn per year by 2037, compared with if the ‘Housing Targets Met’ scenario had come to pass. An allowance of 25% for displacement has then been made on the assumption that some workers would choose to live outside of London and commute in instead if insufficient housing was available under the ‘Past Delivery’ scenario – resulting in lost productivity (to London) of £19.2bn per year.

25 March, 2025

by Matthew Boyd

Learn more

12 February, 2025

Learn more

15 January, 2025

by Oliver Maury, Matthew Hayes

Learn more